Plant-based Eating: Just A Niche Trend?

The Three Driving Forces Shaping the Future of Food, And How Plant-based Brands Can Win

📖 About us: We are a UK startup with a mission to empower a healthier, sustainable future through plant-based transformation. Plantwise meal-planning app 📲 helps users leverage AI to create personalised plant-based dishes with food on hand.

Nearly a quarter of the UK population already identifies as vegan (3%), vegetarian (7%), or flexitarian (13%). But I often get asked "Isn't plant-based just a niche market?" Or similarly, "Why would non-vegans or non-vegetarians bother with this stuff?"

These questions reflect a perception that the plant-based sector is small and limited in its expansion potential. Perhaps it is influenced by the recent news headlines that report on plant-based companies failing and products being pulled.

However, this overlooks the driving forces behind the plant-based movement, which are transforming it from a niche trend into a powerful force shaping the future of food. In my thesis, I identify three key drivers for the long-term outlook of the plant-based sector.

1. Plant-based diets sit at the intersection of health and sustainability

Let’s start with the acknowledgement that everyone's body is unique, and there is no one-size-fits-all approach to diet. It is also important to consider practical factors such as budget, food accessibility, and cooking skills when planning meals.

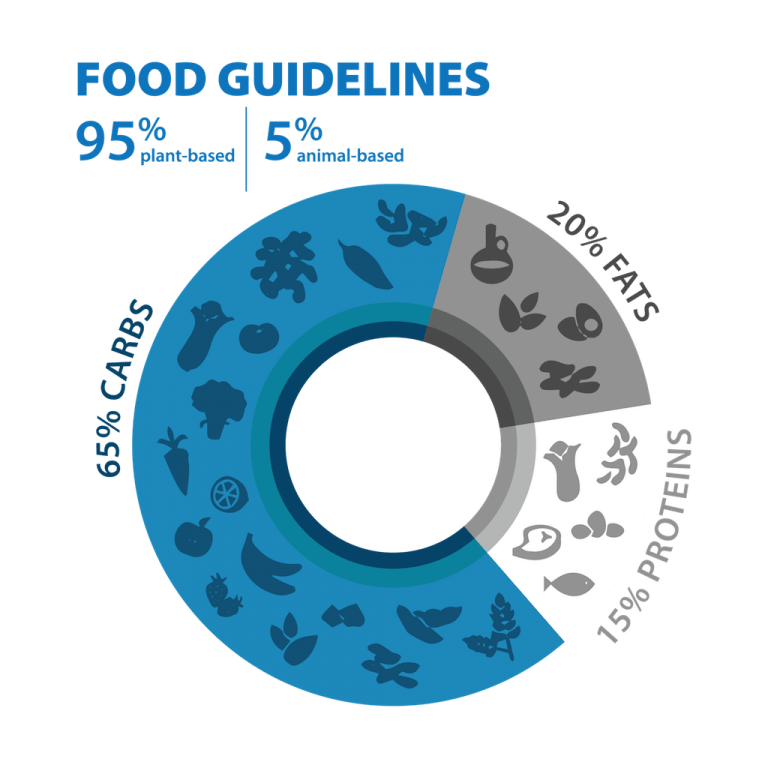

From the Blue Zones (regions with a high number of people living past 100), we observe that limiting animal-based products to a very small percentage (<5%) can greatly improve longevity. By choosing complex carbs from whole grains, we can easily fill our fibre and protein needs without overburdening our bodies. Additionally, factors such as low stress, regular exercise, proximity to nature, and meaningful relationships all contribute to a healthy lifestyle.

In June, the new Nordic Nutrition Recommendations explicitly recommends a predominantly plant-based diet high in vegetables, fruits, berries, pulses, potatoes and whole grains.

Research has shown that a healthful plant-based diet is significantly associated with a lower risk of total CVD and many other chronic diseases. Helping people understand the benefits of consuming more plant-based foods is crucial in driving society towards a healthier future.

To put the impact to scale, the annual healthcare costs relating to CVD in England alone are estimated at £7.4B with an annual cost to the wider economy of £15.8B.

In terms of the environmental impact, meat and dairy generate nearly 15% of total global greenhouse gas emissions, which is greater than all the transportation emissions combined. On the Plantwise app, we help our users visualise the impact of their plant-based food choices. Switching to a plant-based diet can save up to 2.1 tonnes of CO2 per person per year.

2. The plant-based sector is building businesses for future generations.

The growing demand for plant-based products among younger generations is a key driver of the future plant-based trend, as they are more health-conscious, environmentally aware, and open to trying new culinary experiences.

According to Finder UK, 43% of Gen Z planned to cut meat from their diet in 2023. In the US, 79% of the Gen Z population choose to go meatless one day a week, and 65% say they want a more plant-forward diet.

This represents a significant shift in consumer preferences, as Gen Z is more likely to consider sustainability, animal welfare, and personal health when making food choices. This trend is not exclusive to Gen Z. Many young Millennials also share these preferences, indicating a broader shift in consumer behaviour.

As these younger generations mature and gain more purchasing power, the demand for plant-based products is expected to continue to rise. A recent report by Future Market Insights projects that the global plant-based food market will triple to $36B (£29B) by 2033. This growth will be driven by the increasing availability of plant-based alternatives, advancements in product development, and the growing emphasis on health and sustainability among consumers.

3. Macro headwinds and supply-side issues will improve in time

The slump in the plant-based food industry over the past two years has been affected by both macro and supply-side issues.

In terms of macro, the plant-based sector has been hit hard by rising inflation and the high cost of living. As consumers feel the squeeze in their wallets, they tend to opt for cheaper food options. Plant-based meat alternatives have struggled to compete on price.

But why are these alternatives expensive? Plant-based meat, cheese, and dairy alternatives are still in the early stages of development and have not yet achieved the economies of scale needed to match the prices of animal products.

In a previous article, I explained that plant-based protein alternative companies face a fundamental hurdle: they use costly technology to compete with standardised commodities. Additionally, when brands grow, they still need to figure out production and distribution issues.

However, looking ahead to the long term, both macro and supply issues are expected to improve.

Inflation has recently become more in line with past trends. On the supply side, production costs are likely to benefit from Wright's law. According to Wright's law, the production cost of a product tends to decrease by 20% for every doubling of cumulative production volume. This suggests that the cost of producing plant-based meat alternatives will decline rapidly as the industry grows. For example, the cost of a Beyond Burger has already decreased by more than half since its introduction in 2016.

How plant-based businesses can succeed

As plant-based choices become more affordable, convenient, and delicious, they will attract a broader audience beyond the core plant-based community. This will stimulate further innovation and investment in the sector, resulting in even more enticing plant-based options that will revolutionise our eating habits.

My view for the long-term winning brands in the sector is this:

The best plant-based products consider all aspects of taste, price, nutrition and sustainability.

Yes, the bar is that high.

For beverages, plant-based alternatives do serve a hard need, as 68% of the world’s population is lactose intolerant. However, there are regional and personal variations in what consumers taste. For example, having tasted dozens of different oat drink brands, I strongly favour Oatly. Local consumers in the US or Asia may not share this sentiment.

What this means is that plant-based businesses need to localise their product iterations. Collaborations with local partners present the best routes for newcomers. For example, Oatly partners with Lan Fong Yuen to create milk tea, a popular drink in China.

Alternatively, plant-based brands do not necessarily have to adopt the world-domination mentality either. It may be worthwhile forgoing some of the global markets and doubling down on regions they enjoy the biggest advantage. This could reduce capital expenditure and bolster profitability.

Plant-based meat alternatives (PBMAs) paint a more complicated picture, given the growing consumer concerns about processed food. PBMAs regularly receive criticism due to their “processed” nature. This is a power, low-hanging fruit (no pun intended) from the meat industry in their attack that the PBMA brands struggle to defend.

In 2021, Beyond Meat partnered with the Stanford University School of Medicine on a five-year research program. This program aims to provide studies on the health implications of a plant-based diet, including plant-based meat. Additionally, Beyond Meat received certification from the American Heart Association (AHA) for its plant-based steak. In its marketing, Beyond Meat now emphasizes the quality of its ingredients and seeks to establish a connection between its audience and nature.

The future of food is plant-based

I believe the three key drivers I identified above will push the plant-based industry into the mainstream in the next decade, despite the ebbs and flows we experience in the early stages of the industry.

The plant-based food industry is constantly evolving, and companies that can successfully navigate these challenges will be well-positioned to capture a significant share of the market.

Finally, There likely be regional winners rather than one-winner-takes-all. Non-plant-based brands will also get very much involved in creating plant-based products that match their existing offerings.

🖋️ Get in touch

If there is a specific piece of news, topic, or brand that interests you, please share it with us!

Email: hello@plantwiseapp.com