🥛Oatly's Q1 2023: Playing Offense and Focusing on Growth

Improved Execution, Top Line Growth, Expanded Distribution, Continued Brand Building and Greater Operational Efficiency

📖 About us: We are a UK startup with a mission to empower a healthier, sustainable future through plant-based transformation. Ranked in the top App Store charts across Europe, the Plantwise meal-planning app 🔗📲 offers protein-rich recipes that are both tasty and affordable.

Playing Offense

If Oatly’s 2022 theme was “Turnaround”, their 2023 is becoming defined by “Playing Offense”. Not only did Oatly show accelerated top-line growth in Q1, they also reduced losses in the bottom line and appeared much more confident in the drive towards profitability.

A Change of Guard

Having led Oatly for more than a decade, CEO Toni Petersson announced in the earning call that he will transition from his role as CEO to Co-Chairman. Jean-Christophe Flatin, currently Oatly’s Global President of over a year, will take over as CEO beginning 1st June. Before joining Oatly, Flatin was part of the Mars Leadership Team, leading Mars Edge, a segment focused on human nutrition.

Q1 Result Overview

In Q1 2023, Oatly reported a revenue increase of 17.7% compared to the prior year, reaching $195.6 million. On a constant currency basis, revenue would have increased by 23.5% to $205.3 million. Oatly’s EBITDA & adjusted EBITDA losses both showed significant improvements compared to the prior year Q1 and the Q4 of 2022. Oatly has reiterated its fiscal 2023 guidance for each metric. The revenue growth was driven by increased volume sold across all regional segments and the price increases implemented in EMEA and the Americas.

Encouragingly, Oatly's gross margin improved 150 basis points from Q4 to 17.4%. This was primarily due to price increases and improved customer and channel mix, although they were partially offset by lower utilisation of Asia facilities and higher production costs in the Americas.

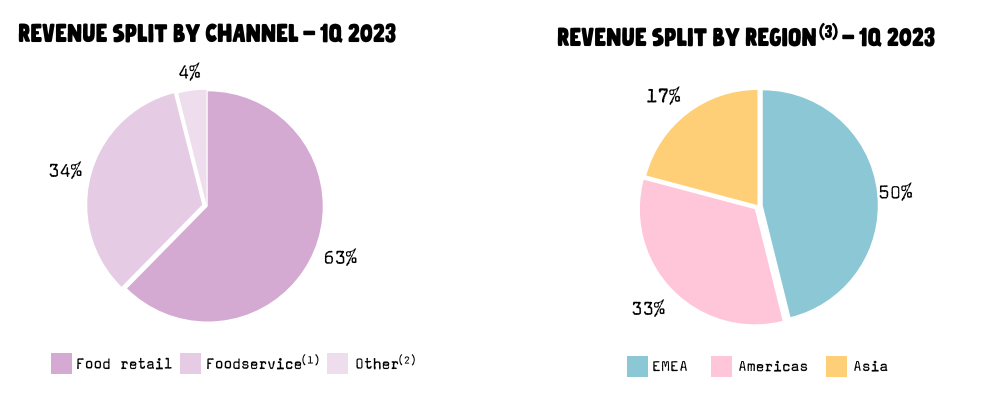

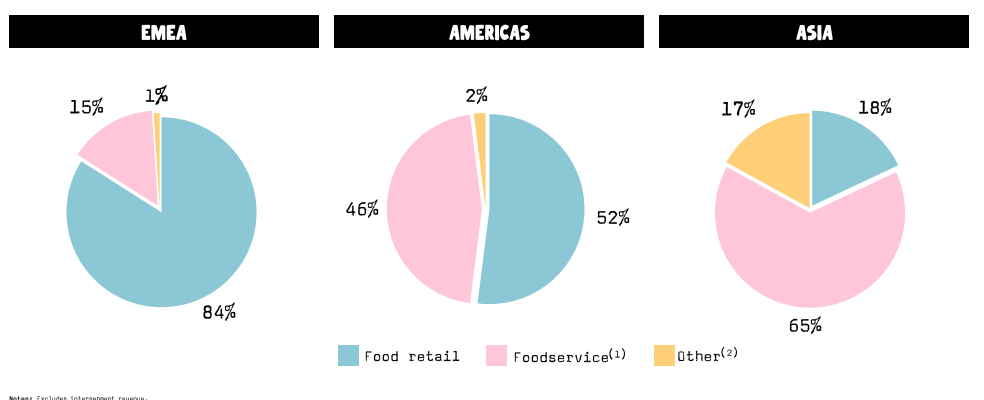

Revenue Split by Channels and Regions

EMEA is the main contributor to Oatly’s revenue, accounting for half, followed by the Americas and Asia. Most of Oatly’s revenues are also driven by retail, i.e. off the supermarket shelves.

However, there is a big regional difference in the channel split, as EMEA is predominantly retail-driven, Asia is mostly foodservice driven, while the Americas are roughly 50:50.

Sign up for a 1-week free trial to access our in-depth analysis, including insights on regional growth, channel splits, and strategies. Don't miss out on the opportunity to stay informed and ahead of the curve. Claim your free trial today.

Keep reading with a 7-day free trial

Subscribe to Plantwise 🌱 to keep reading this post and get 7 days of free access to the full post archives.